Steps in the Home Buying Process

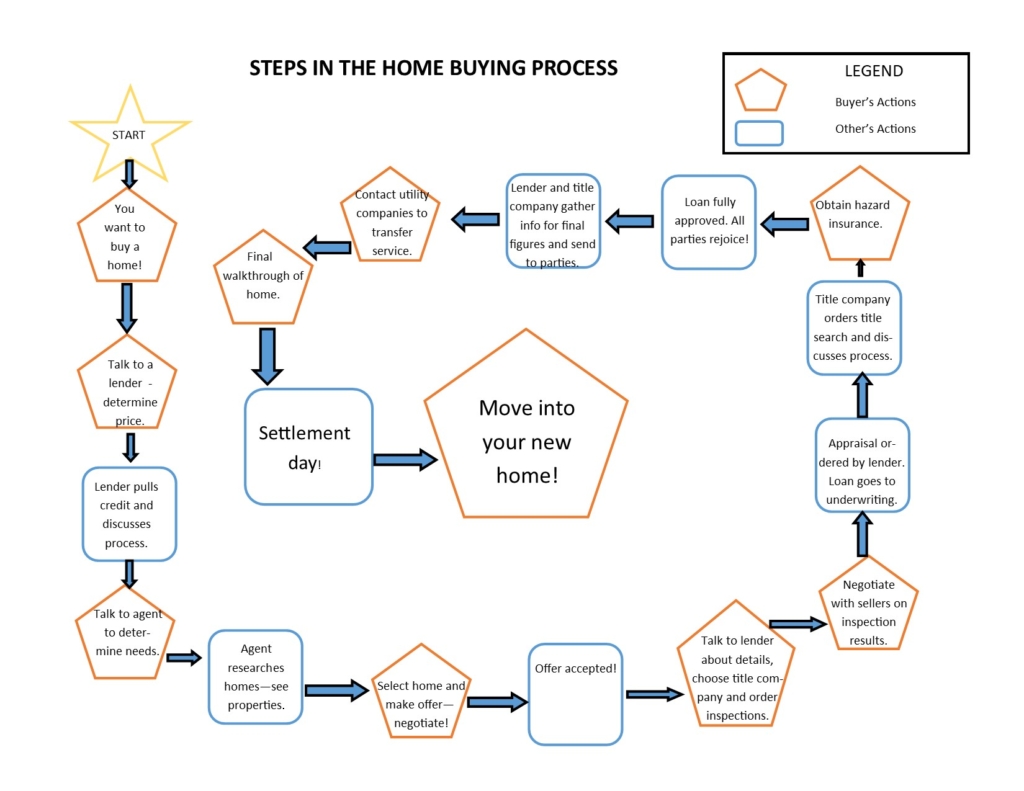

For new home buyers, the entire home buying process can be overwhelming. We know there are many steps involved in buying a new home. The Nancy Bowlus Team will do our best to keep the buying process on track and as painless as possible.

While more buyers now use the Internet to gain access to listings, or available properties for sale, it is still a good idea to use an agent. We as the agent bring value to the entire process: we are available to analyze data, answer questions, share their professional expertise, and handle all the paperwork and legwork that is involved in the real estate transaction.

Getting Started

How do you decide whether to add on to an existing home or purchase a new one?

There are a few things to consider, including cost, individual needs, and what will add value down the road. Also important: your emotional attachment to the existing home.

Other considerations:

- Can you finance the home improvement with your own cash or will you need a loan?

- How much equity is in the property? A fair amount will make it that much easier to get a loan for home improvements.

- Is it feasible to expand the current space for an addition?

- What is permissible under local zoning and building laws? Despite your deep yearning for a new sunroom or garage, you will need to know if your town or city will allow such improvements.

- Are there affordable properties for sale that would satisfy your changing housing needs?

- Explore your options. Make sure your decision is one you can live with – either under the same roof or under a different one.

How much can I afford?

The general rule is that you can buy a home that costs about two-and-one-half times your annual salary. A good real estate agent or lender can determine how much you can afford and estimate the maximum monthly payment based on the loan amount, taxes, insurance and other expenses. Your real estate agent can help you to figure out now how your income, debts, and expenses can affect what you can afford, and how much you may be able to borrow to purchase a home, and even prepare an estimated settlement sheet for homes you like.

Appraisals & Market Value

Are there standard ways to determine how much a home is worth?

Yes. A comparative market analysis and an appraisal are the two most common and reliable ways to determine a home’s value.

Your real estate agent can provide a comparative market analysis, an informal estimate of value based on the recent selling price of similar neighborhood properties. Reviewing comparable homes that have sold within the past year along with the listing, or asking, price on current homes for sale should prevent you from overpaying.

A certified appraiser can provide an appraisal of a home. After visiting the home to check such things as the number of rooms, improvements, size and square footage, construction quality, and the condition of the neighborhood, the appraiser then reviews recent comparable sales to determine the estimated value of the home.

Lenders normally require an appraisal – which runs between $200 to $300 – before they will approve a mortgage loan. This protects the lender by ensuring the home is worth the money you want to borrow.

You also can check recent sales in public records, through private firms, and on the Internet to help you determine a home’s potential worth.

How do you determine how much a home is worth?

The short answer: a home is ultimately worth what is paid for it. Everything else is really an estimate of value. Take, for example, a hot seller’s market when demand for housing is high but the inventory of available homes for sale is low. During this time, homes can sell above and beyond the asking price as buyers bid up the price. The fair market value, or worth, is established when “a meeting of the minds” between the buyer and the seller takes place.

What about appraised value and market value?

A certified appraiser who is trained to provide the estimated value of a home determines its appraised value. The appraised value is based on comparable sales, the condition of the property, and several other factors.Market value is the price the house will bring at a given point in time once the buyer and seller establish a “meeting of the minds” on price.

What is the difference between list price and sales price?

The list price is a seller’s advertised price, or asking price, for a home. It is a rough estimate of what the seller wants to complete a home sale. A seller can price high, low – (which seldom happens), or very close to the amount they want to get. A good way to determine if the list price is a fair one is to look at the sales prices of similar homes that have recently sold in the area. The sales price is the actual amount a home sells for.

Closing Costs

Is it possible to save on closing costs?

Certainly, once you get past the sticker shock. Closing costs are expensive. They can average between 5 to 6 percent of the total home purchase price. But here are a few ways to save:

- Haggle with the seller. He may pay all or part of the closing costs.

- Nab a no-point loan. You may have to pay a higher interest rate, but if you are strapped for cash and can qualify for a higher interest rate, you may find this type of loan can significantly reduce your closing costs.

- Grab a no-fee loan. Although the fee is usually wrapped into a higher rate loan, it does offer one advantage – you get to save on the amount of cash you would need up-front.

- Secure seller financing. These loans typically avoid the traditional fees or charges imposed by lenders.

- Shop ‘til you drop for the best deal. Every lender has its own unique fee structure; you are bound to find one that works for you.

Is there anything I should know about closing day?

Yes. The following to-do list can help save you a few headaches and keep the closing on track:

- Keep extra money in your account. Something unexpected can pop up during the closing that will require more money out of your pocket. Take your checkbook. Even better, find out how much you will need to pay and write a certified check for the total amount.

- Take your loan commitment letter. Use it to verify loan approval in case of a mistake or misunderstanding with the lender.

- Take your contract to purchase. Pull it out if something a little suspicious comes up.

- Take your personal ID. A driver’s license or other personal identification will do.

- Do a before-closing inspection. It is always a good idea, when possible, to walk through the property to make a list of any problems.

- Utilities. Arrange in advance to have the water and electric meters read on closing day and the service switched to your name to prevent interrupted service. The same applies for the fuel tank.

What are closing costs?

Closing, or settlement, costs are expenses over and above the price of the property. Both the buyer and seller incur some of these expenses when transferring ownership of a property. Who actually pays, however, often depends on local custom and what the buyer or seller negotiates. Closing costs normally include title insurance, loan points, escrow or closing day charges, property taxes, and document fees. The lender provides an estimate of closing costs for prospective homebuyers.